Startup Grind Chengdu | Paris #41: 硅谷之外 : 新兴市场崛起的科创新星

收起

活动内容收起

Beyond the Valley: The Rise of Deep-tech Startups from the Emerging Economies

硅谷之外 : 新兴市场崛起的科创新星

Brought to you by Startup Grind Chengdu & Startup Grind Paris

South America, South East Asia, Eastern Europe… Tech startups from developing countries CAN compete with and even surpass Silicon Valley tech stars!

The Silicon Valley is ceasing to be the global monopolist of innovation. Recent years have seen a new wave of Deep-Tech disruptors from the emerging markets. This means that the next unicorn can come from anywhere, which makes the usually US-focused VCs to discover new geographies and talents. For founders, it is a great opportunity to get funded by the Western investors. However, more players and more diversity also means greater competition and more cautious investors. Where to search funding for a start-up from an emerging country? How to convince foreign investors? What mistakes to avoid? These and more you will hear from Alexander Piskunov, partner at Ruvento who had experience of investing both in the US and around the world.

南美,东南亚,东欧...下一个科技独角兽可能出现在任何地方! 在新兴市场慢慢发展起来科技创业公司已经具有可以和硅谷科技巨头竞争甚至胜出的潜质!

硅谷长期以来在科技行业的主导地位正在受到来自新兴市场的竞争者们的强烈冲击。我们有理由相信下一个科技独角兽有可能在任何地方诞生,这也使得长期以来以美国市场为主导的风投公司将目光投向其他市场。作为创业者,获得西方投资者的青睐将会是绝好的机会,然而投资者选择的多样性也意味着更大的竞争以及投资者对其选择的谨慎。新兴市场的科创公司如何寻求投资?如何获得投资人的信任?有哪些错误需要避免?在美国及其他市场拥有多年投资经验的风投机构Ruvento Ventures合伙人 Alexander Piskunov 将为我们带来这些问题的答案。

Potential Questions

- Why Western VC funds are interested in investing in startups from emerging markets?

- Mistakes of founders from emerging markets when seeking overseas funding

- How should startups from emerging markets approach the fundraising from Western funds?

- Are there any alternative ways to get funded early?

- What kind of start-ups from emerging markets investors try to find?

- How COVID will change investors’ attitude to emerging markets?

- Are big VCs from the emerging countries delivering the same value as the Western VCs? Is competition between them increasing?

- Should founders relocate/found a company in another country to secure easy access to capital?

- 为什么西方风投机构对新兴市场的科技公司产生了浓厚的兴趣?

- 新兴市场科技公司创始人在寻求海外投资时的常见错误

- 新兴市场的科技公司如何通过有效的方式向西方投资者募集资金

- 是否有其他方式可以在早期获得投资?

- 投资者在新兴市场寻找什么样的优质科技公司?

- 投资者对新兴市场的投资态度在新冠疫情的冲击下有何改变?

- 新兴市场的大型风投机构是否与西方资本一样关注科技领域?二者之间的竞争是否日趋激烈?

- 创业者是否应该在特定的地理区位/国家创立他们的公司从而更加便捷地获得投资?

Notice:

Interview Language: English

Event Platform: Zoom

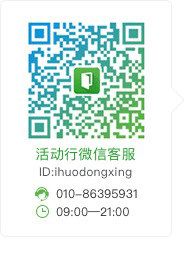

Scan the QR Code below to join for:

Chinese translation (WeChat only); Add questions for Q&A session; Stay connected!

Meeting Link will be sent to you by Email/in WeChat group on June 8th at NOON sharp!

注意:

访谈语言:英文

活动工具:Zoom

扫码进群:群里中文翻译(仅限微信群);准备Q&A环节的提问;交朋友!

会议链接将在6月8日正午准时通过邮件/微信群发给您!

About the Speaker

Alexander Piskunov

Alexander is a partner of a Ruvento Ventures, a deep-tech venture capital fund, specialising in AI, robotics and quantum computing investments in emerging markets. Previously, he worked in pan-European tech-focused investment banking and cross-border private equity funds. Alexander has also founded his own business importing exotic wines into British hotels, restaurants and bars.

Alexander是科技行业风投机构Ruvento Ventures的合伙人,投资重点关注发展中国家新兴市场的人工智能领域,机器人技术领域和量子计算领域。在此之前,他曾在欧洲以技术为中心的投资银行和跨境私募股权基金工作。亚历山大还创立了自己的公司,将世界各地的小众葡萄酒引入英国。

活动标签

最近参与

您还可能感兴趣

您有任何问题,在这里提问!

全部讨论

活动主办方更多

Startup Grind Chengdu

Startup Grind is the largest independent global startup community, actively educating, inspiring, and connecting 2,000,000 founders in 500 cities.